Sec Practice For Investment Fund Solicitation

- Sec Funds Of Funds Proposal

- Sec Practice For Investment Fund Solicitation Program

- Investment Fund Wikipedia

SEC Division of Corporation Finance Compliance and Disclosure Interpretations, Securities Act Rules (updated Aug. 6, 2015), at Question 256.26. Hutton & Company, SEC No-Action Letter (Dec. 3, 1985) (“In determining what constitutes a general solicitation the SEC Staff has underscored.

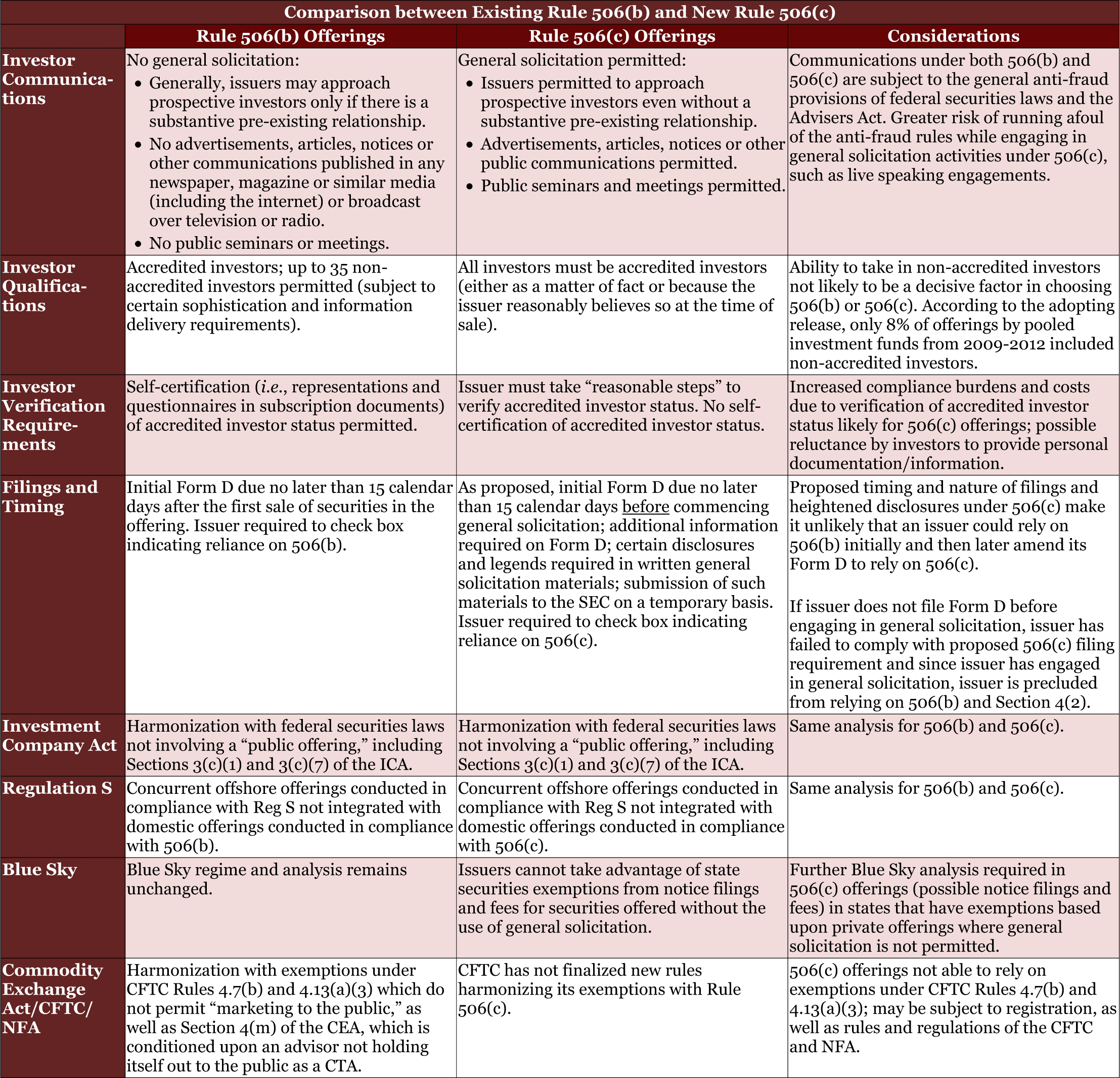

A Small Entity Compliance Guide IntroductionEnacted in 2012, the Jumpstart Our Business Startups Act, or JOBS Act, is intended, among other things, to reduce barriers to capital formation, particularly for smaller companies. The JOBS Act requires the SEC to adopt rules amending existing exemptions from registration under the Securities Act of 1933 and creating new exemptions that permit issuers of securities to raise capital without SEC registration. On July 10, 2013, the SEC adopted amendments to Rule 506 of Regulation D and Rule 144A under the Securities Act to implement the requirements of Section 201(a) of the JOBS Act. The amendments are effective on September 23, 2013. Rule 506(b) of Regulation DSection 4(a)(2) of the Securities Act exempts from registration “transactions by an issuer not involving any public offering.” Rule 506(b) is a rule under Regulation D that provides conditions that an issuer may rely on to meet the requirements of the Section 4(a)(2) exemption. One of these conditions is that an issuer must not use general solicitation to market the securities.“General solicitation” includes advertisements published in newspapers and magazines, public websites, communications broadcasted over television and radio, and seminars where attendees have been invited by general solicitation or general advertising. In addition, the use of an unrestricted, and therefore publicly available, website constitutes general solicitation.

The solicitation must be an “offer” of securities, but solicitations that condition the market for an offering of securities may be considered to be offers. Rule 506(c) of Regulation DSection 201(a) of the JOBS Act requires the SEC to eliminate the prohibition on using general solicitation under Rule 506 where all purchasers of the securities are accredited investors and the issuer takes reasonable steps to verify that the purchasers are accredited investors.To implement Section 201(a), the SEC adopted paragraph (c) of Rule 506.

Updated as of August 18, 2017The staff of the Division of Investment Management (the “Division”) has prepared the following responses to questions about rule 206(4)-5 (the “pay to play rule”) under the Investment Advisers Act of 1940. We may update this posting from time to time with responses to additional questions or to make other modifications, such as if the rule is amended. These responses represent the views of the staff of the Division. They do not constitute a rule, regulation, or statement of the Securities and Exchange Commission, and the Commission has neither approved nor disapproved this information.

Sec Funds Of Funds Proposal

The adopting release for the pay to play rule, dated July 1, 2010 (the “Adopting Release”) can be found at:. Compliance Dates Question I.1. Compliance Date for Recordkeeping Obligations.Q: When must an adviser subject to the pay to play rule begin to comply with the related requirement in Advisers Act rule 204-2 to make and keep a record of all government entities to which it provides or has provided advisory services (or which are or were investors in any covered investment pool to which the adviser provides or has provided investment advisory services)?A: An adviser subject to the pay to play rule that is also subject to Advisers Act rule 204-2 must begin to keep such a record on March 14, 2011 (see section III.C.

Of the Adopting Release). However, an adviser to a registered investment company that is a covered investment pool need not begin to keep such a record of government entities that are or were investors in such covered investment pool until September 13, 2011 (see section III.D of the Adopting Release). (Posted March 22, 2011).We note that the staff of the Division issued a letter on September 12, 2011 regarding an adviser to a registered investment company's compliance with these requirements in Advisers Act rule 204-2. A copy of this letter is available at:. Question I.2. Coverage Period for Recordkeeping Requirements.Q: Advisers Act rule 204-2 provides that an adviser subject to the pay to play rule must make and keep a record of all government entities to which it provides or has provided advisory services (or which are or were investors in any covered investment pool to which the adviser provides or has provided advisory services) for the past five years, but “not prior to September 13, 2010” (see rule 204-2(a)(18)(i)(B)).

Does this mean that an adviser’s records must extend back to September 13, 2010?A: No. An adviser must begin to create and maintain a list of current government clients (if it has any) on March 14, 2011, except clients that are registered investment companies with respect to which it must begin to create and maintain such list on September 13, 2011. (Posted March 22, 2011). Question I.3. Compliance Date for Regulated Person RecordkeepingQ: The Commission recently extended the compliance deadline for the pay to play rule's ban on third-party solicitation from June 13, 2012 to nine months after the compliance date of a final rule adopted by the Commission by which municipal advisor firms must register under the Securities Exchange Act of 1934 (see Investment Advisers Act Release No. May an adviser also delay compliance with the related recordkeeping requirements?A: The Division would not recommend enforcement action to the Commission if an adviser does not comply with the requirement of Advisers Act rule 204-2(a)(18)(i)(D) to 'make and keep a list of the name and business address of each regulated person to whom the adviser provides or agrees to provide, directly or indirectly, payment to solicit a government entity for investment advisory services on its behalf' until it is required to comply with the rule's third-party solicitation provisions (Modified July 27, 2012). Question I.4.

Sec Practice For Investment Fund Solicitation Program

Compliance Date for the Ban on Third-Party SolicitationQ: In a June 2012 release (Investment Advisers Act Rel. 3418), the Commission extended the compliance date for the ban on third-party solicitation in the Advisers Act pay-to-play rule (rule 206(4)-5) until nine months after the compliance date of a final rule adopted by the Commission by which municipal advisors must register under the Securities Exchange Act of 1934.

Investment Fund Wikipedia

On June 25, 2015, notice was provided of the third-party solicitation ban compliance date, as set in the June 2012 release, as July 31, 2015. (See.) Neither FINRA nor the MSRB have yet adopted pay to play rules.